While in the industry to find a home, while you want a reduced down-payment mortgage, you have heard the phrase mortgage insurance mentioned will ultimately. Exactly what are financial insurance coverage, how come you really need it, when will it go-away, as well as how do you cure they?

What is actually Financial Insurance policies?

Home loan Insurance rates (MI) is actually americash loans Redvale an insurance policy that lowers the possibility of and come up with a loan so you can people that happen to be getting down below 20% of your own purchase price . Mortgage insurance policy is requisite on conventional financing with a down payment below 20% and is generally requisite to your FHA and USDA loans.

Which have a conventional loan, the lender arranges for MI with a personal team. Personal Mortgage Insurance policies (PMI) prices are different predicated on deposit matter and you may credit history. Generally speaking, PMI was cheaper than FHA MI having people with a good credit score. Oftentimes, PMI is actually paid off month-to-month. You can also get a great PMI rules the spot where the whole level of the MI was paid-up-side as part of the closing costs, otherwise funded on amount borrowed.

Exactly why do Funds You prefer MI?

Individual mortgage insurance allows so much more homebuyers the chance to purchase good household prior to when envisioned because allows lenders to offer financing that have dramatically reduced down costs. MI offsets the chance the financial institution perform typically assume on a good low-down percentage transaction. Specific antique loan items support a downpayment while the reasonable while the step three% of your loan amount, as long as the loan comes with PMI provided.

Do not mistake MI with other well-known insurance coverage, for example homeowners, flooding, otherwise quake. Brand new MI plan handles the lending company in the eventuality of default. For folks who fall behind on your payments, the borrowed funds insurance policies doesn’t do just about anything to you while the consumer; your credit score may suffer, and nonetheless clean out your residence compliment of property foreclosure.

Whenever Really does Home loan Insurance Be removed?

Instead of which have FHA and you will USDA money, which more often than not wanted MI with the longevity of the loan, towards a traditional financing, t he MI appear away from if you are paying it month-to-month . Home loan insurance commonly automatically terminate if the mortgage harmony has reached 78% of the amazing value of your residence . For this specific purpose, unique well worth essentially means either the brand new contract conversion price and/or appraised worthy of of your house at the time you purchased they, whichever is gloomier. You can also request to eradicate the mortgage insurance policies ahead of following. We’ll talk about one techniques soon.

It is important to keep in mind that in case the MI are a single-go out fee in the closure, or is funded into your loan amount, it generally will not terminate, while doing so you don’t discovered a reimbursement. Financial insurance termination was a benefit to finance that include the latest percentage included in the monthly payment . Therefore, you ought to contrast each type off MI together with your Financial Mentor before choosing and that coverage to utilize.

As stated prior to now, your monthly MI tend to immediately terminate if the mortgage equilibrium is at 78%. What a lot of people do not know is that you could obtain the newest MI ahead regarding before you get to one area. You have the directly to demand that servicer get rid of the mortgage insurance policies when your loan balance is at 80% of one’s house’s brand-new well worth. There are additional conditions you ought to satisfy in order to terminate the fresh new PMI in your financing:

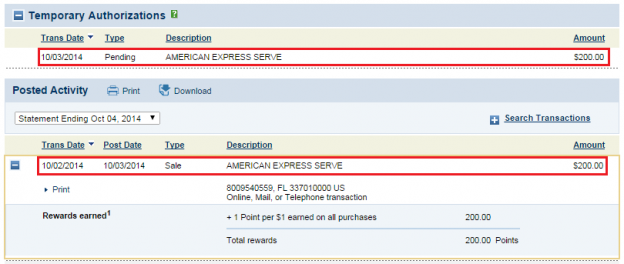

- Their consult need to be in writing. There is incorporated an illustration letter getting asking for home loan insurance cancellation:

- You truly need to have a reasonable percentage history

- You need to be most recent on your payments.

- Your lender need one to approve there are no extra liens on your house.

- Your own bank may need you to promote proof the home value has not refused below the brand new property value your house.

Within our shot consult page, you can easily find we incorporated a paragraph for you to imply this new home loan insurance provider team information. How can you know what company provides your own mortgage insurance rates? Based on You Mortgage Insurance companies, you’ll find already half dozen effective MI businesses in the usa. On the closing documentation, the loan’s Closure Disclosure will teach the new MI providers name toward they.

In general, financial insurance is practical for a number of applicants, specifically first-go out homebuyers whom might not have highest off costs readily available. MI helps make a lot more feel when you understand what its, why it’s called for, and ways to eliminate it when the time comes.

Do you have a lot more questions relating to how home loan insurance policies can work for your requirements included in a minimal down-payment financing? Fill out the design below, or contact us today!