If you don’t have the luxurious out of waiting to develop property improvement offers funds, tackle do it yourself plans throughout the years as your earnings lets. Consider this to be strategy as strengthening and you may draining numerous short, short-title home improvement deals fund socking aside $a hundred four weeks getting four days, then showing up in do it yourself shop to possess gadgets and you can supplies value $390.

This plan has some big experts, particularly zero obligations and you can minimal impact on cash flow. Nonetheless it means organization and you can diligence you to definitely, become honest, of many Doing it yourself do-it-yourself aficionados can’t accomplish. That have shorter financing to free and much more time to waiting and you will spend, the possibility of serious cost overruns otherwise endeavor waits try deeper compared to a loan-pushed race to achievement.

- Low interest. Even the better-accredited consumer loan applicants won’t be eligible for rates as low as well-certified property owners can get with the HELOCs as a result of Contour and you may home equity money.

- Versatile Conditions. HELOCs typically offer ten-12 months draw periods, being best for expanded-stage systems and you may phased ideas where the new resident would prefer to make a single loan application. Home security loans have also offered terminology, even if you should consider life attract will set you back from the loan’s pros.

- Prospective Income tax Masters. For individuals who itemize write-offs, you happen to be in a position to deduct attract accumulated to the a home collateral financing. Demand a taxation elite group to own great tips on your own income tax problem.

As well as the chance of shedding most of your quarters in the event that you be unpaid, the most significant disadvantage to household collateral borrowing items ‘s the onerous software process. It is not a history-time funding solution.

4. Explore a subject I Mortgage

This 1 is practical for quicker programs. A title I Property Upgrade Mortgage are an effective federally covered mortgage supported by the brand new U.S. Agency regarding Homes and you will Urban Development (HUD).

Because they’re federally covered, Name I money are noticed because the much safer from the individual lenders you to question her or him chiefly finance companies, borrowing unions, and you can expertise lenders. Credit-confronted borrowers who don’t qualify for unsecured unsecured loans which have beneficial costs and you may terms and conditions may qualify for unsecured Identity I funds, even if all the bank varies and you can acceptance isn’t really secured.

HUD makes sure Term I finance with principals varying as much as $eight,five hundred. Which is enough to fund short to help you modestly sized home improvement methods, not large-violation remodels. Huge finance must be safeguarded of the assets identity. In all cases, your house should be accomplished and you can filled for at least 90 weeks afterwards.

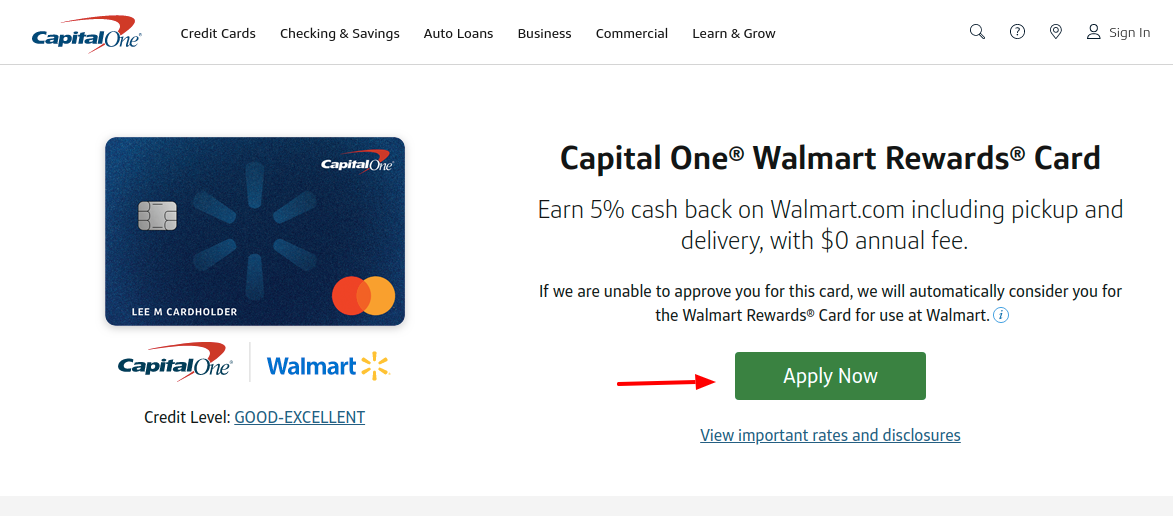

5. Benefit from 0% Annual percentage rate Credit card Advertisements

To help you be eligible for an effective 0% Apr get strategy, you typically you would like a great FICO score northern of 680 so you can 700, as well as a typical percentage background, lowest borrowing from the bank usage, and you can lowest loans-to-income ratio.

The money maximum are technically their card’s borrowing limit, but you should not get anywhere close to maxing away your own cards. Make an effort to keep your credit usage ratio not as much as fifty% eg, a balance off no more than $5,000 on an excellent $10,100 credit limit. Stop billing non-home-improvement-relevant commands with the 0% Annual percentage rate card inside promotional several months.

0% Apr credit card promotions loans Lake Pocotopaug essentially try not to past forever; the latest longest I have seen toward an established basis is 21 months. When the interest accrues retroactively, you should intend to pay off your entire harmony through to the promotion end time or deal with ruinous focus charges. No matter if it doesn’t, it’s to your advantage so you’re able to no your equilibrium otherwise obtain it only you can through to the venture runs out. You can easily hence have to front-weight assembling your shed-related instructions and you can spend the majority of the fresh advertising and marketing several months purchasing her or him down.